By Ayush Bansal | January 2026

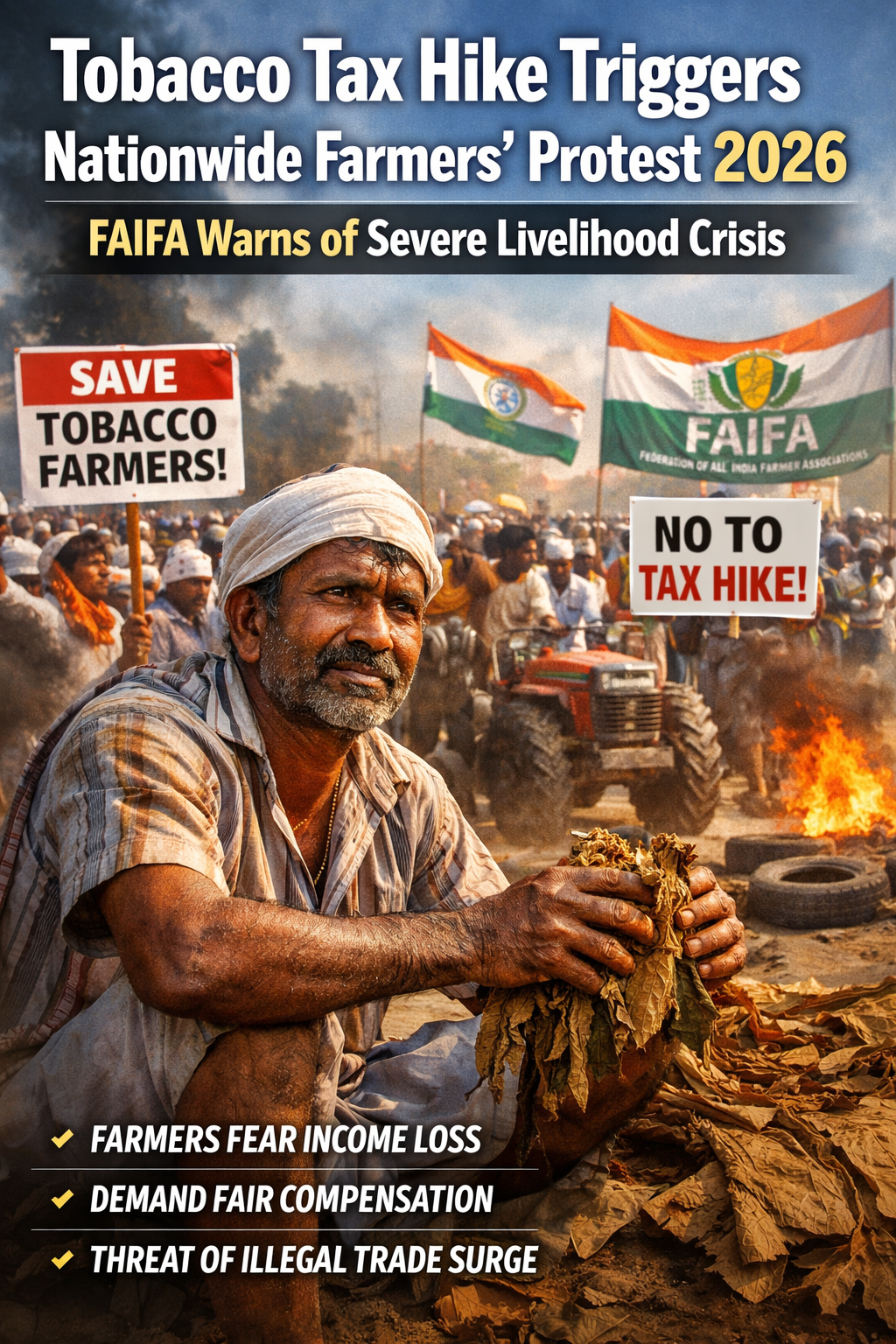

A fresh wave of farmers protest has erupted across India’s tobacco-growing belts after the Union Government announced a steep hike in excise duty on cigarettes and pan masala, effective February 1, 2026. The decision, which ends a seven-year freeze on tobacco taxes, has drawn sharp criticism from farmers and agricultural bodies, with the Federation of All India Farmer Associations (FAIFA) warning that the move could devastate rural livelihoods.

Farmers from Andhra Pradesh, Karnataka, Telangana, Gujarat, and Maharashtra have taken to the streets, alleging that the policy targets consumption but ends up punishing cultivators instead of corporations.

What Triggered the Tobacco Farmers’ Protest?

The government’s decision to sharply raise tobacco excise duty is aimed at curbing consumption and addressing public health concerns. However, farmer groups argue that the policy was introduced without stakeholder consultation, ignoring the supply-side impact on agriculture.

India is among the world’s largest producers and exporters of tobacco, with the crop supporting nearly 45 lakh people directly and indirectly. Any disruption in demand, farmers say, has immediate consequences for prices, procurement, and rural employment.

“You cannot fix a health problem by destroying farmers’ income overnight,” a FAIFA spokesperson said during a protest in Vijayawada.

FAIFA’s Stand: “Health Policy Cannot Ignore Farmer Survival”

FAIFA has strongly opposed the sudden tax hike, stating that while public health goals are important, farmers should not become collateral damage.

According to FAIFA:

- Tobacco farmers already face rising cultivation costs and climate risks

- A sudden tax hike will reduce cigarette and smokeless tobacco sales

- Lower demand will lead to price crashes for raw tobacco leaves

FAIFA has demanded that the government:

- Introduce phased and predictable tax increases

- Provide income protection or compensation

- Support crop diversification with assured procurement

“Without viable alternatives, asking farmers to abandon tobacco is unrealistic,” FAIFA said in its official statement.

States on the Frontline of the Protest

The impact of the tobacco tax hike is expected to be most severe in:

- Andhra Pradesh – India’s largest producer of flue-cured Virginia (FCV) tobacco

- Karnataka – Major exporter of tobacco leaves

- Gujarat & Telangana – Key hubs for chewing tobacco and bidi production

Farmer unions in these states have warned of sustained protests, including supply-chain disruptions, if their demands are ignored.

Fear of Demand Collapse and Market Uncertainty

Farmers argue that tobacco cultivation involves long-term planning, with sowing decisions made months in advance. Sudden policy shifts can leave growers stuck with unsold produce.

A farmer from Prakasam district said,

“Once we plant tobacco, there is no exit. If companies cut procurement, we are ruined.”

Experts also warn that excessive tax hikes may fuel illegal trade and smuggling, hurting both legal farmers and government revenue.

Government’s Position: Health Comes First

The Finance Ministry has defended the tax hike, citing India’s high burden of tobacco-related diseases. Health officials note that tobacco consumption causes nearly 13 lakh deaths annually and imposes massive healthcare costs.

The government maintains that higher taxes are globally recognised as one of the most effective tools to reduce tobacco use, especially among youth.

However, critics say the current approach lacks a farmer rehabilitation roadmap.

Economic Impact Beyond Farms

The issue goes beyond cultivation. A sharp decline in tobacco production could affect:

- Agricultural exports

- Employment in curing, grading, and transport

- State revenues linked to tobacco trade

Economists caution that abrupt policy changes can destabilise rural economies already under stress.

What Lies Ahead?

FAIFA and other farmer bodies have sought urgent consultations with the Finance and Agriculture Ministries. If talks fail, unions have threatened to escalate protests ahead of Budget 2026, turning the issue into a major political flashpoint.

Policy experts suggest a balanced strategy—combining health objectives with farmer transition support—is the only sustainable solution.

Conclusion: A Policy at a Critical Crossroads

The tobacco tax hike has reopened a long-standing debate between public health priorities and farmer welfare. While reducing tobacco consumption is essential, farmer groups insist reforms must be humane, gradual, and inclusive.

As FAIFA’s warning echoes across rural India, the government now faces a crucial test: reform with empathy or risk deepening agrarian distress.

Contact taxgiveindia.com for professional tax related services.

FAQs: Tobacco Tax Hike & Farmers’ Protest

Q1. Why are tobacco farmers protesting in 2026?

Because the sudden excise duty hike may reduce demand, crash prices, and hurt farmer income.

Q2. What is FAIFA’s view on the tobacco tax hike?

FAIFA supports health goals but opposes abrupt tax increases without farmer compensation or alternatives.

Q3. When will the new tobacco tax apply?

From February 1, 2026.

Q4. Which states are most affected?

Andhra Pradesh, Karnataka, Gujarat, Telangana, and Maharashtra.

Q5. Can this policy increase illegal tobacco trade?

Experts warn that steep hikes may encourage smuggling and unregulated sales.