Running a small business or startup in India is exciting, but along with growth comes the responsibility of managing taxes. Many small entrepreneurs often ignore tax planning in the early stages, which later leads to higher tax payments, penalties, or even cash flow issues.

In this blog, we will discuss step-by-step Tax Planning for Small Businesses and Startups in India, covering both Income Tax and GST, along with key deductions and compliance requirements.

Table of Contents

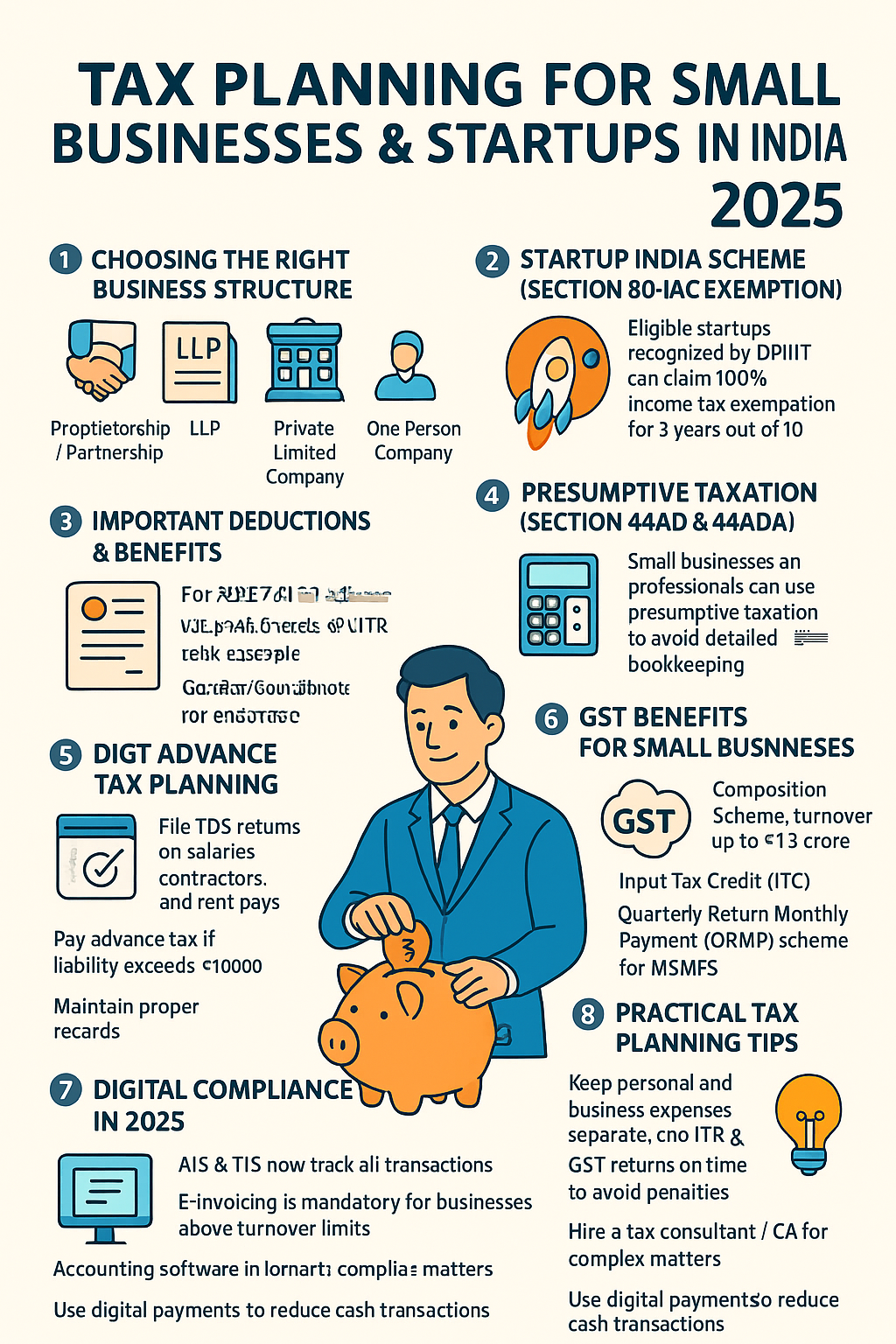

1. Choosing the Right Business Structure

The first step in tax planning starts from the business structure. The type of entity you choose affects your tax rate, compliance, and benefits.

- Proprietorship – Easy to start, taxed as per individual slab rates. Suitable for very small businesses.

- Partnership Firm – Taxed at a flat rate of 30% plus surcharge and cess.

- LLP (Limited Liability Partnership) – Flat tax rate of 30%, but partners get limited liability protection.

- Private Limited Company – Taxed at 22% (domestic companies) or 15% (manufacturing startups under Section 115BAB).

- One Person Company (OPC) – Similar to Pvt. Ltd. Company but allows single ownership.

Choosing the right entity can reduce tax liability and also make it easier to attract investors.

2. Proper Accounting and Record-Keeping

Maintaining accurate books of accounts is the foundation of tax planning. Startups often mix personal and business expenses, which makes it difficult to claim deductions.

- Use accounting software like Tally, Zoho Books, or QuickBooks.

- Maintain separate bank accounts for business.

- Record all cash expenses properly.

- Keep track of GST invoices, TDS certificates, and advance tax payments.

3. Income Tax Deductions Available

The Income Tax Act provides several benefits to small businesses and startups:

(a) Presumptive Taxation (Section 44AD & 44ADA)

- Small businesses with turnover up to ₹2 crore can opt for presumptive taxation (Section 44AD).

- Professionals (doctors, lawyers, consultants, etc.) with receipts up to ₹50 lakh can opt under Section 44ADA.

In this scheme, you are not required to maintain detailed books, and income is calculated at 8% (6% for digital receipts) for businesses and 50% for professionals.

(b) Startup India Tax Exemption (Section 80-IAC)

Eligible startups registered with DPIIT can claim 100% income tax exemption for 3 years out of 10 years, provided turnover is less than ₹100 crore.

(c) Other Deductions

- Depreciation on assets like laptops, machinery, and furniture.

- Rent, telephone, electricity, internet, and staff salaries are deductible expenses.

- Section 80JJAA – Deduction for new employment generation.

- R&D expenditure can be claimed as a business deduction.

4. TDS and Advance Tax Compliance

Many small businesses forget about TDS (Tax Deducted at Source) and Advance Tax.

- Deduct TDS while making payments like contractor fees, professional fees, rent, interest, etc. (as per Income Tax Act).

- Deposit TDS every month and file TDS returns (Form 26Q, 24Q, etc.) quarterly.

- Pay advance tax in four installments (15th June, 15th Sept, 15th Dec, 15th March) if tax liability is more than ₹10,000 in a year.

Non-compliance leads to penalties and interest under Sections 234B & 234C.

5. GST Planning for Small Businesses

GST is another major area where startups struggle. Proper GST planning can reduce costs and avoid penalties.

- Register under GST if turnover exceeds the threshold (₹40 lakh for goods, ₹20 lakh for services).

- Small businesses can opt for the Composition Scheme (Section 10 of CGST Act) – Pay tax at a fixed rate (1% for traders, 5% for restaurants, 6% for service providers) without complex compliance.

- Claim Input Tax Credit (ITC) properly on business purchases.

- File GST returns (GSTR-1, GSTR-3B, GSTR-9) on time.

6. Tax Benefits for Startups Raising Funds

Many startups raise funds through angel investors, venture capital, or ESOPs.

- Angel Tax Exemption (Section 56(2)(viib)) – Recognized startups are exempt from this tax.

- ESOPs (Employee Stock Option Plans) – Taxation is deferred for employees of eligible startups.

- Investors can also claim exemption under Section 54GB by investing in startups.

7. Professional Tax Planning for Small Businesses & Startups in India

- Separate personal and business expenses.

- Invest in tax-saving instruments (ELSS, PPF, NPS, insurance).

- Hire taxgiveindia.com to avoid errors.

- Plan cash flow to ensure funds are available for advance tax and GST payments.

- Use government schemes like MSME benefits, Startup India, and Make in India incentives.

Conclusion

For small businesses and startups in India, tax planning is not just about saving money, but also about staying compliant and building investor confidence. By choosing the right structure, claiming available deductions, complying with TDS and GST rules, and using startup tax exemptions, entrepreneurs can save taxes and focus on growth.

If you are a small business owner or startup founder, make sure you consult a tax professional regularly and use these tax planning strategies to keep your finances strong in 2025 and beyond.