Are you sending money abroad for education, medical needs, travel, or investments in 2025? The Income Tax on Foreign Remittances has made some important changes to TCS (Tax Collected at Source) under the Liberalised Remittance Scheme (LRS). If you’re not aware of the new rules, you might end up paying more or receiving a tax notice.

Table of Contents

What is Foreign Remittance under LRS?

Under the Liberalised Remittance Scheme (LRS) by the Reserve Bank of India (RBI), a resident individual is allowed to remit up to USD 2,50,000 per financial year outside India for various purposes such as:

- Education

- Medical treatment

- Travel abroad

- Investment in shares, mutual funds, or real estate

- Gifting money to relatives

- International donations

This scheme applies to Indian citizens sending money to foreign countries for personal use and is not meant for business remittances.

What is TCS on Foreign Remittance?

Tax Collected at Source (TCS) is a tax collected by banks or authorised dealers when a person sends money abroad under the LRS. The bank collects a certain percentage of the remitted amount as TCS and deposits it with the government on your behalf.

TCS is not a separate tax. It can be adjusted or claimed as a refund while filing your Income Tax Return (ITR), similar to TDS.

Updated TCS Rates on Foreign Remittances – Applicable in 2025

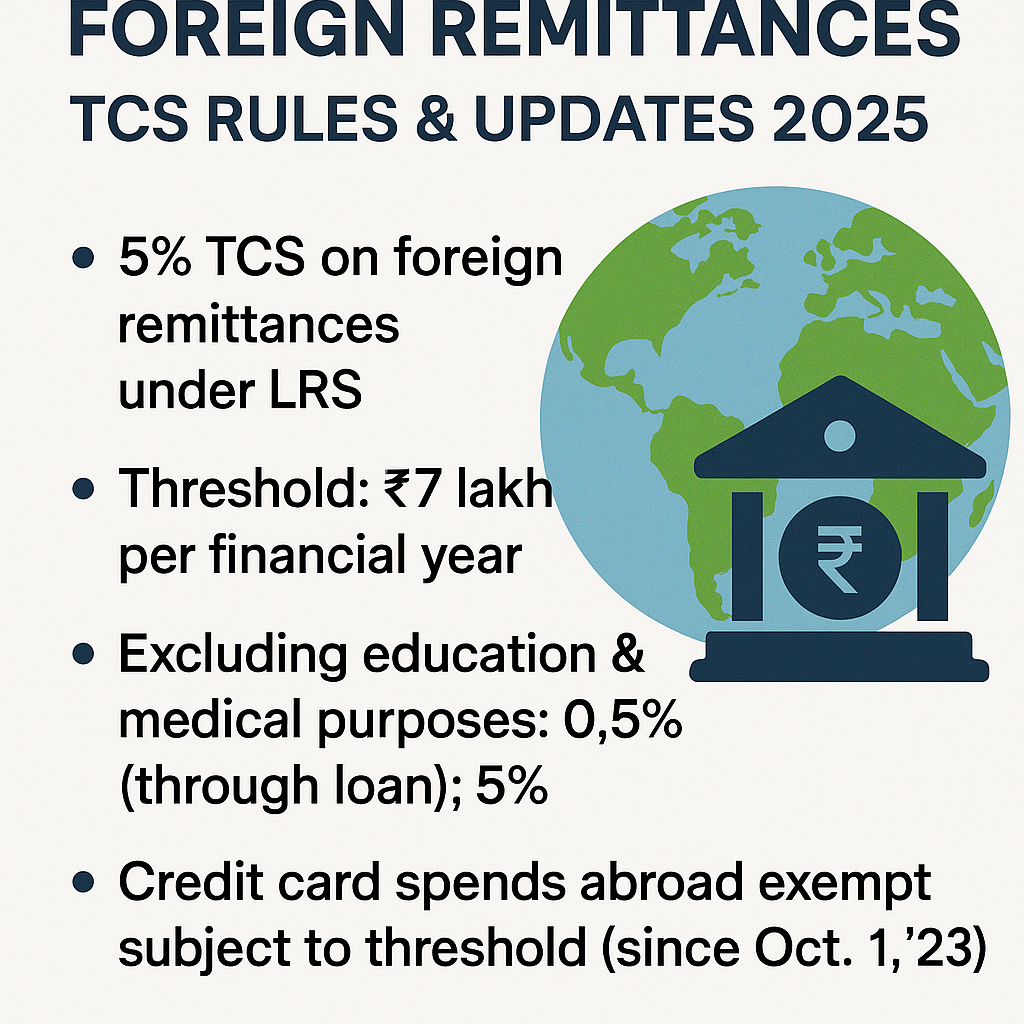

The TCS rates were amended through the Finance Act 2023 and became effective from 1st July 2023. These rates continue to apply in 2025.

| Purpose of Remittance | TCS Rate | Threshold Limit | Remarks |

|---|---|---|---|

| Education – Funded by Loan from Bank | 0.5% | Above ₹7 lakh/year | On amount exceeding ₹7 lakh |

| Education – Self-Funded | 5% | Above ₹7 lakh/year | No TCS up to ₹7 lakh |

| Medical Treatment Abroad | 5% | Above ₹7 lakh/year | Applies only on excess amount |

| Overseas Tour Packages | 20% | No threshold (from ₹1) | TCS from first rupee |

| Other Remittances (e.g., gifts, crypto, investments) | 20% | Above ₹7 lakh/year | High rate to discourage untracked flow |

Note: If PAN is not furnished, higher TCS rates may apply under Section 206CC.

Relevant Sections of Income Tax Act

- Section 206C(1G) – This is the main provision governing TCS on LRS remittances and overseas tour packages.

- Section 139 – Relates to filing of Income Tax Return and claiming TCS credit.

- Rule 37BB – Governs submission of Form 15CA and 15CB for foreign remittance transactions.

- Section 2(24)(xvi) – Treats TCS as part of income, and thus eligible for credit/refund.

- Section 206CC – Applies higher TCS rate if PAN is not submitted.

Real-Life Examples for Income Tax on Foreign Remittances

Example 1: Education Remittance – Self-Funded

You send ₹12 lakh abroad for your child’s education in 2025 (not via loan):

- TCS applicable = 5% on ₹5 lakh (₹12L – ₹7L)

- TCS = ₹25,000

- The bank will collect ₹25,000 and deposit with the IT Department.

- You can claim this amount as credit while filing your ITR.

Example 2: Tour Package Booking

You book an international holiday package worth ₹4 lakh:

- TCS @20% = ₹80,000

- Total payment to travel agency = ₹4.8 lakh

- The ₹80,000 will appear in your Form 26AS and can be adjusted while filing ITR.

Example 3: Crypto Investment Abroad

You invest ₹10 lakh in crypto assets on a foreign exchange:

- TCS @20% = ₹2 lakh

- Even if the investment is not income, TCS still applies at source.

Claiming TCS While Filing ITR

TCS is not a final tax. You can claim a refund or adjustment by:

- Filing your Income Tax Return (ITR) on time.

- Checking Form 26AS or Annual Information Statement (AIS) for TCS credits.

- Reporting the correct TCS amount in your ITR.

- The refund (if applicable) will be processed after verification by the IT Department.

Important Tips for Taxpayers

- Always ask your bank or authorised dealer how much TCS will be collected before remitting funds.

- Keep proper records of the remittance, TCS deducted, and purpose.

- File ITR even if your income is below taxable limits, if TCS is deducted.

- Avoid splitting remittances across banks to hide from threshold – this may be flagged.

Recent Developments – July 2025

- Many taxpayers have received TCS mismatch notices due to incorrect AIS reporting.

- Banks are now strictly following TCS rules even for small remittances.

- Several representations have been made to the Finance Ministry to reconsider the 20% TCS rate, especially for tour packages.

- CBDT is working on simplified refund processes for TCS credits claimed in ITR.

Conclusion

TCS on foreign remittances is a tool to track money leaving India and ensure tax compliance. While the rates may seem high in certain cases, you are not losing money permanently – the TCS amount is refundable or adjustable in your tax return. Always plan your remittances wisely, keep track of TCS deducted, and consult a tax expert if needed.

If you’re confused about how much TCS you’re paying, or how to claim it back, you can contact our expert team at TaxGiveIndia.com for end-to-end support in tax filing, AIS reconciliation, and refund tracking.