Table of Contents

1. What is Import of Goods under GST?

According to Section 2(10) of the IGST Act, “Import of goods” means bringing goods into India from outside the territory of India.

It includes goods brought by air, sea, courier, or post, for business or personal use.

Example:

You import plastic granules from Singapore to Delhi Port – this is treated as import of goods and IGST is applicable.

2. Which Taxes Are Levied on Import of Goods?

At the time of import, taxes are charged under the Customs Act and IGST Act as follows:

| Tax / Duty | Description |

|---|---|

| Basic Customs Duty (BCD) | Charged under Customs Act, based on HSN code and trade agreement |

| IGST (18%, 12%, etc.) | Charged under IGST Act, same rate as applicable on local supply of goods |

| Social Welfare Surcharge | 10% on BCD (not on IGST) |

| Anti-Dumping / Safeguard Duty | Only if applicable for certain products, especially Chinese goods |

Note: GST Compensation Cess may apply on luxury or sin goods like tobacco, coal, etc.

3. Who Pays GST on Imported Goods?

The Importer (whether individual, firm, or company) pays IGST under Reverse Charge Mechanism (RCM) at the time of customs clearance.

This IGST payment is done via the Bill of Entry filed on ICEGATE (Customs portal).

This tax is compulsory even if supplier is abroad and not registered in India.

4. How is IGST on Imports Calculated?

IGST is levied on “Assessable Value + Customs Duty + Cess”

IGST = (CIF Value + BCD + Cess) × IGST Rate

Where:

- CIF = Cost + Insurance + Freight

- BCD = As per Customs Tariff

- IGST Rate = Based on HSN (e.g. 18%, 12%)

Example Calculation:

Let’s say you import machinery from Germany worth ₹5,00,000.

| Component | Amount |

|---|---|

| CIF Value | ₹5,00,000 |

| Basic Customs Duty (10%) | ₹50,000 |

| Social Welfare Surcharge (10%) | ₹5,000 |

| Subtotal (Taxable Value) | ₹5,55,000 |

| IGST @18% | ₹99,900 |

| Total Landed Cost | ₹6,54,900 |

5. Can Importers Claim ITC of IGST Paid?

Yes, IGST paid on import of goods is eligible as Input Tax Credit (ITC) under GST, provided:

- GSTIN is mentioned correctly in Bill of Entry

- Goods are used in business (not personal)

- IGST credit reflects in ICEGATE GST portal linkage

- ITC is claimed in GSTR-3B of the month in which goods were received

No ITC is allowed on:

- Basic Customs Duty (BCD)

- Social Welfare Surcharge

- Late filing penalties or demurrage

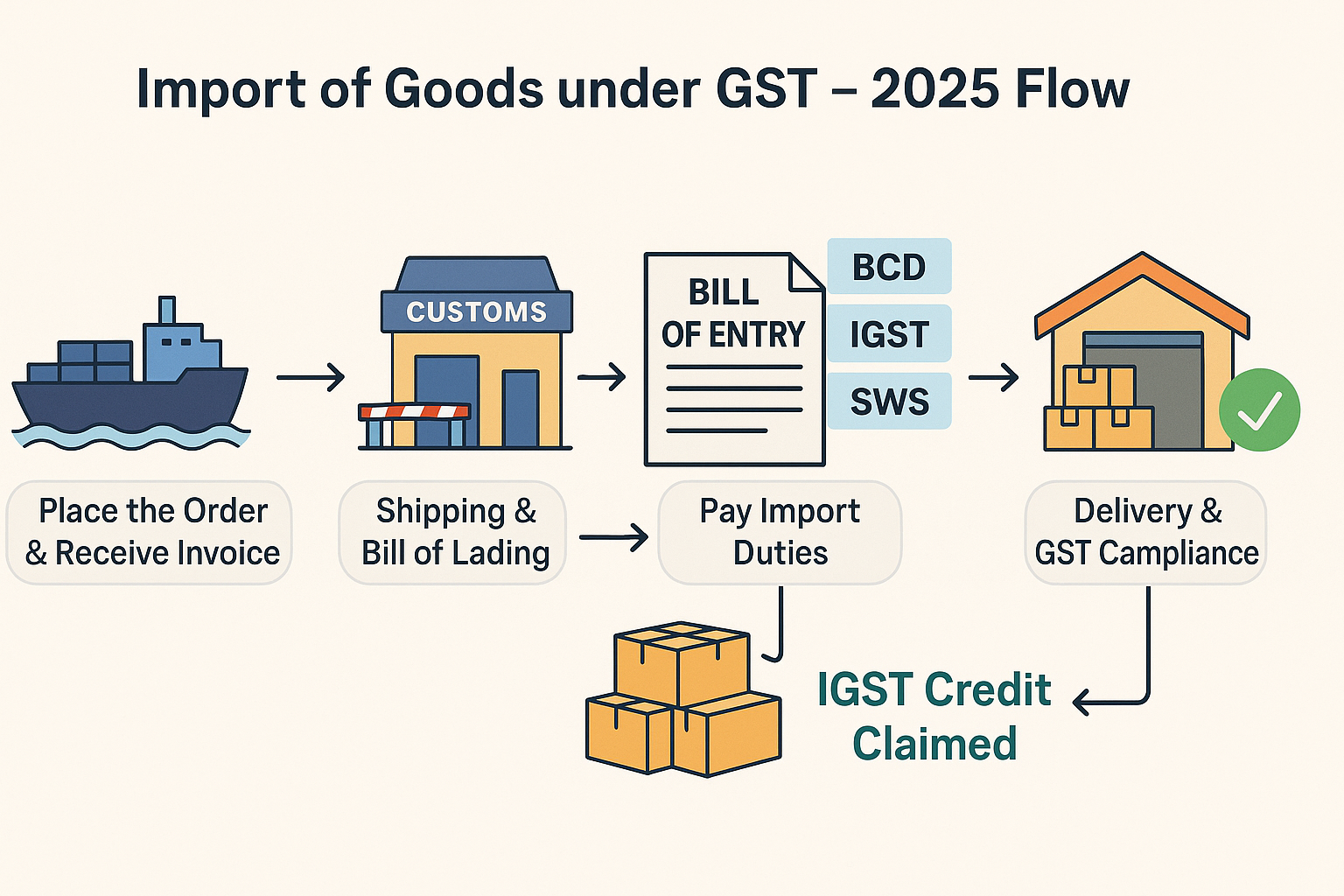

6. Step-by-Step Import Procedure in India (2025)

Step 1 – Place Order & Finalize Contract

Importers place Purchase Order (PO) with foreign supplier, agree on delivery terms (FOB or CIF), and payment terms (LC, TT, etc.)

Step 2 – Shipping & Arrival of Goods

Supplier ships goods with documents:

- Commercial Invoice

- Bill of Lading / Airway Bill

- Packing List

- Certificate of Origin

Step 3 – File Bill of Entry on ICEGATE

Importer or their CHA files Bill of Entry online on ICEGATE portal, with:

- Correct GSTIN

- HSN code

- Customs port code

- Currency value

Step 4 – Pay Customs Duties & IGST

Duties are paid via TR-6 Challan (Challan No. 280 or 281 depending on type).

Step 5 – Goods Cleared by Customs

Post document verification and examination (if any), Customs releases goods.

Step 6 – Claim ITC in GSTR-3B

IGST credit is auto-populated in ICEGATE dashboard, which importer can download GSTIN-wise and match with GSTR-3B.

7. Common Errors Importers Make (and Their Impact)

| Mistake | Result / Problem |

|---|---|

| Wrong or missing GSTIN in Bill of Entry | IGST not reflected in GST portal → No ITC |

| Mismatch in values between Invoice & BE | GST mismatch notice or audit issue |

| Not downloading ICEGATE IGST data monthly | Missed ITC reconciliation |

| Not classifying goods correctly (wrong HSN) | Wrong IGST rate → Penalty + tax difference |

| Using personal PAN instead of GSTIN | No ITC, goods treated as personal use |

8. Legal & Practical Notes

- GST ITC is available only on goods used in business.

- Bill of Entry is treated as “GST invoice” for ITC claim.

- No e-way bill is required when goods are first imported.

- For high-value imports, Customs may do detailed checking (RMS alert).

9. Real-Life Case Scenarios for Import of Goods

Case 1:

A Delhi importer filed Bill of Entry using wrong GSTIN. Even after paying ₹1.2 lakh IGST, ITC was not available in GST portal. He had to revise the BE through Customs – delayed refund for 4 months.

Case 2:

An Amazon seller imported electronic items using individual PAN. He couldn’t claim IGST ITC and had to pay full GST again on selling in India. Total tax loss: ₹42,000.

10. Frequently Asked Questions (FAQs)

Q1. Can I import goods using my personal name?

Yes, but ITC will not be available as GSTIN is required.

Q2. Can I revise a Bill of Entry if wrong GSTIN is entered?

Yes, you can file for amendment with Customs. But it takes time and may need approval.

Q3. Does GSTIN need to be linked to ICEGATE?

Yes. One-time registration is mandatory to auto-fetch IGST paid data.

Q4. Can I claim IGST credit on imported capital goods?

Yes, if used for business. Example: machinery for manufacturing.

Q5. What is the due date to claim ITC on imported goods?

Latest by 30th November following the end of financial year or before filing annual return, whichever is earlier.

11. Final Checklist for Importers under GST

- Get your GSTIN linked on ICEGATE

- Use correct HSN codes and invoice values

- File Bill of Entry carefully with GSTIN

- Keep digital and hard copies of all documents

- Claim IGST credit only if goods are used for business

- Reconcile ICEGATE data with GSTR-3B monthly

Need Help?

If you are:

- Facing IGST mismatch issues

- Not able to claim ITC due to wrong GSTIN

- Confused about importing under company vs personal name

Get in touch with taxgiveindia.com for professional support – documentation review, ICEGATE-GST reconciliation, and ITC assistance.