Healthcare is a basic necessity, and the government has provided GST relief to hospitals and medical services. However, not everything in a hospital bill is tax-free — there are grey areas that confuse both patients and healthcare providers.

This article explains which GST on hospital services are exempt , which attract GST, the relevant GST sections, key compliance points, and recent developments.

Table of Contents

1. GST Law on Healthcare Services

Under Notification No. 12/2017 – Central Tax (Rate), healthcare services provided by a clinical establishment, authorised medical practitioner, or para-medics are exempt from GST.

Relevant GST Sections:

- Section 2(74) of the CGST Act, 2017 – Defines healthcare services.

- Section 11 of the CGST Act, 2017 – Empowers the government to exempt goods or services.

Definition:

Healthcare services mean services by way of diagnosis, treatment, or care for illness, injury, or deformity in any recognised system of medicine in India.

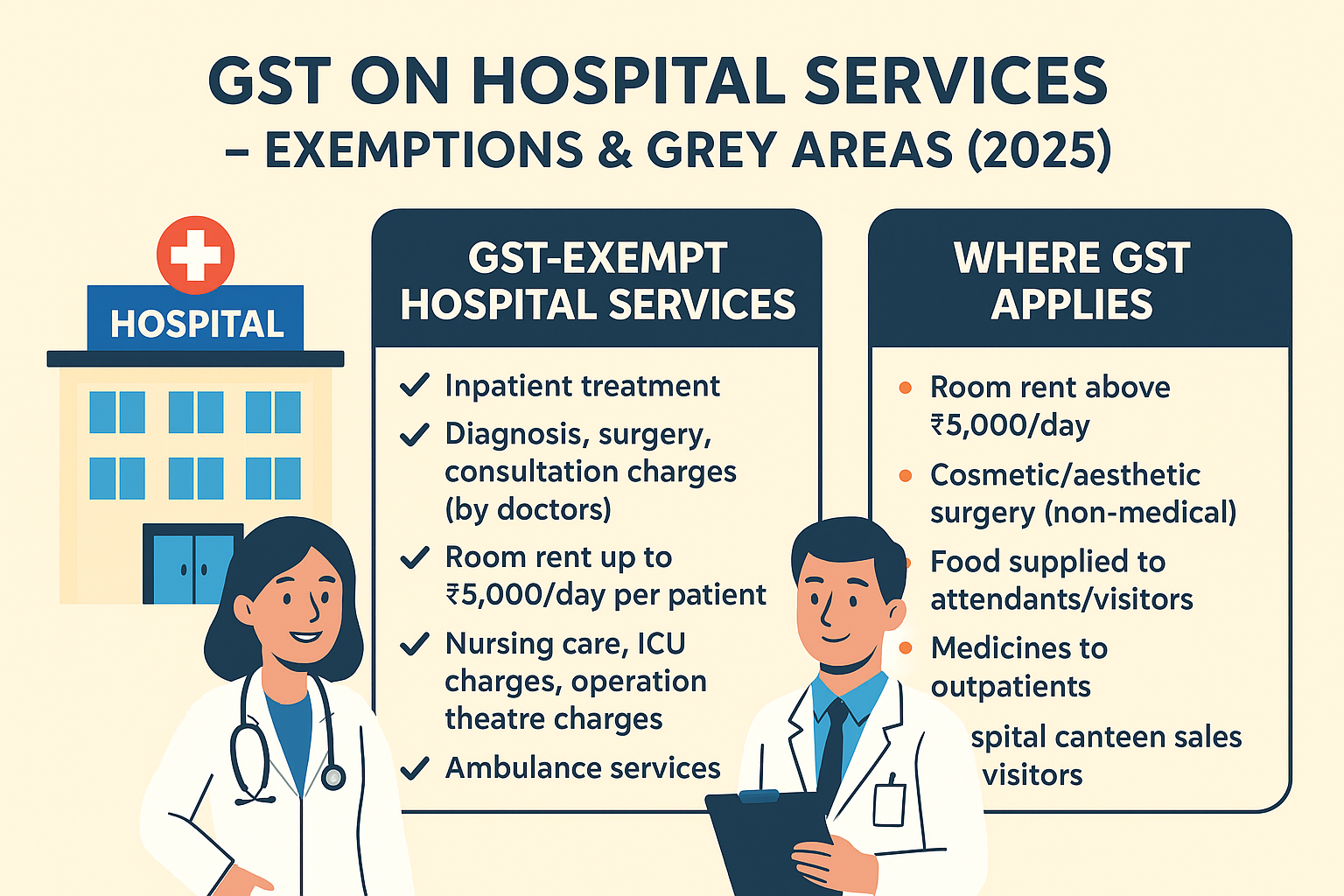

2. GST on Hospital Services – Exempt

Fully GST-Free:

- Inpatient treatment (admitted patients)

- Consultation, surgery, diagnosis (by doctors)

- Room rent up to ₹5,000/day per patient

- Nursing, ICU, operation theatre charges (as part of treatment)

- Ambulance services

Example:

If admitted for heart surgery and your hospital bill is ₹1.2 lakh, no GST applies on surgery or room rent if it is below ₹5,000/day.

3. Where GST Applies on Hospital Services – Grey Areas

Some hospital-related supplies attract GST despite the core treatment being exempt:

| Service / Item | GST Rate | Notes |

|---|---|---|

| Room rent above ₹5,000/day | 5% | Entire amount taxable, without ITC (Notification 03/2022-CT) |

| Cosmetic/aesthetic surgery (non-medical) | 18% | Exceptions for reconstructive procedures |

| Food supplied to attendants/visitors | 5% / 18% | Depends on type of supply |

| Medicines to outpatients | 5% / 12% | As per GST rate for medicines |

| Hospital canteen sales to visitors | 5% / 18% | Restaurant rate applies |

| Health check-up packages for corporates | 18% | Considered business service |

| Renting space within hospital to pharmacies | 18% | Considered commercial rent |

4. Case Law & Advance Rulings

- Columbia Asia Hospitals Pvt Ltd – AAR Karnataka: Medicines and consumables supplied to inpatients are part of composite supply and exempt. For outpatients, GST applies.

- Kauvery Hospital – AAR Tamil Nadu: Room rent above threshold attracts GST even if treatment is exempt.

These rulings confirm that inpatient treatment packages are GST-free, but standalone supplies to non-admitted patients may be taxable.

5. GST Compliance Tips for Hospitals

- Separate Billing: Maintain clear segregation between taxable and exempt services.

- Room Rent Monitoring: Flag cases crossing ₹5,000/day for GST calculation.

- Maintain Records: Keep detailed records to defend in case of departmental audit.

- Avoid Wrong ITC Claims: No ITC on exempt healthcare services — only claim on taxable supplies.

- Regular GST Review: As rules and thresholds change, periodically review billing practices.

6. Practical Examples

Example 1 – GST Free

- Room Rent: ₹4,800/day × 4 days = ₹19,200 (No GST)

- Surgery: ₹70,000 (No GST)

- Medicines for inpatient: ₹10,000 (No GST)

- Total Payable: ₹99,200

Example 2 – GST Payable

- Room Rent: ₹6,200/day × 4 days = ₹24,800 → GST @ 5% = ₹1,240

- Surgery: ₹70,000 (No GST)

- Food for attendant: ₹1,500 → GST @ 5% = ₹75

- Total Payable: ₹97,615

7. Key Takeaways

- Essential healthcare services are GST-exempt.

- Room rent above ₹5,000/day attracts 5% GST.

- Cosmetic treatments, corporate check-ups, and certain canteen/food sales are taxable.

- Medicines for inpatients are exempt, but for OPD patients GST applies.

- Hospitals should ensure clear separation of taxable and non-taxable items in invoices.

8. Conclusion

The GST law tries to balance affordability in healthcare with revenue requirements. While essential treatment remains tax-free, certain non-core hospital services do fall under GST. Proper documentation, billing segregation, and awareness of exemptions can help hospitals stay compliant and patients avoid surprise charges.

Contact Taxgiveindia.com for taxation related services.