Got old GST demands or pending appeals?

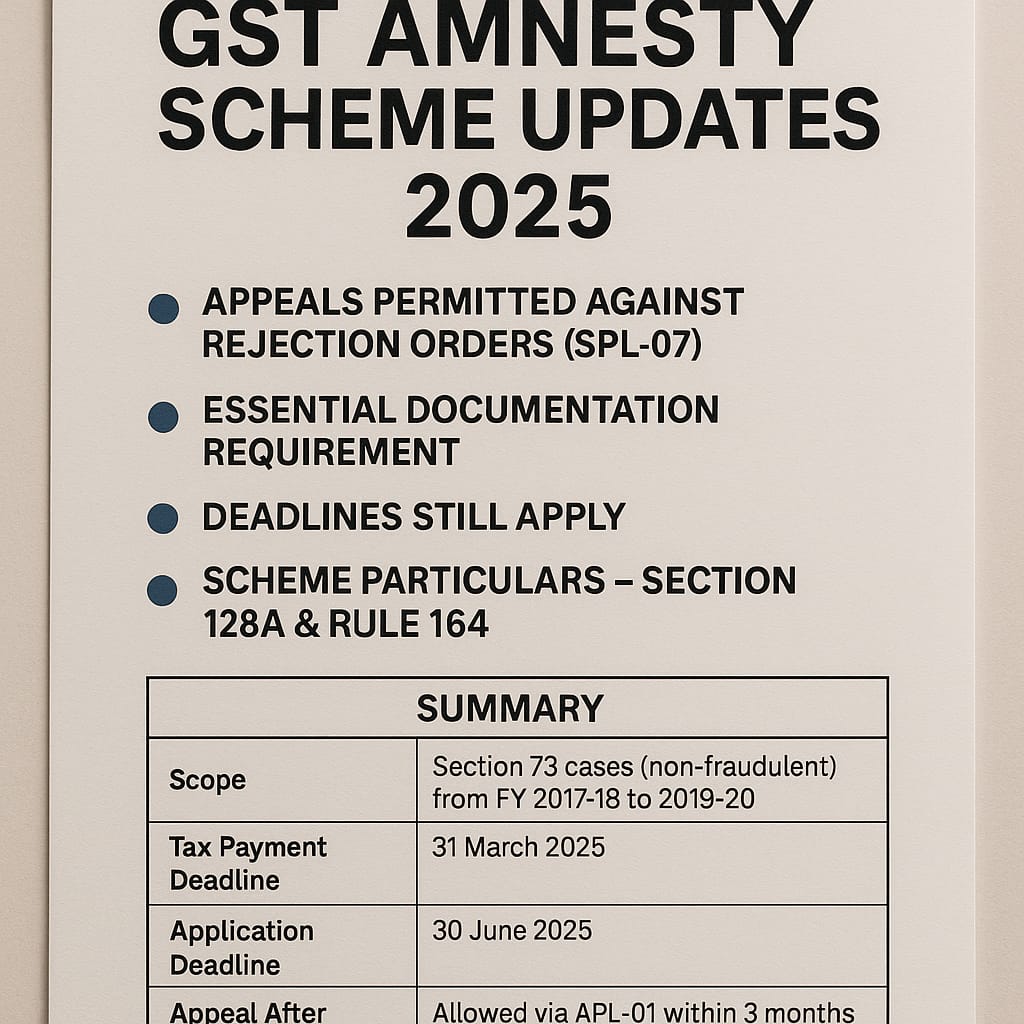

The Government of India has introduced the GST Amnesty Scheme under Section 128A of the CGST Act, giving businesses a final chance to settle past dues without penalty or interest.

This blog explains the scheme, process, legal references, real-life cases — all in simple, client-friendly language.

- For expert GST help, visit www.TaxGiveIndia.com

Table of Contents

What is the GST Amnesty Scheme? (Section 128A)

Launched under the Finance Act 2024, the GST Amnesty Scheme under Section 128A offers:

- Relief from penalty and interest

- Available for FY 2017–18, 2018–19, and 2019–20

- Applicable only to Section 73 (non-fraud) cases

- Tax payment must be made by 31 March 2025

- Application must be filed by 30 June 2025

Not applicable for fraud-related cases (Section 74) or for wrongful refunds.

Mandatory Step – Withdraw Pending Appeal

To apply under the amnesty scheme, you must withdraw any pending appeal under Section 107.

| Appeal Filed Before | Withdrawal Mode |

|---|---|

| 21 March 2023 | Offline request to Appellate Authority |

| After 21 March 2023 | Online via Form APL-01 on GST portal |

Proof of appeal withdrawal is required during application.

How to Apply for GST Amnesty – Step-by-Step

- Withdraw appeal and keep acknowledgment

- Pay basic tax as per demand/order (no interest or penalty)

- Submit your application using the appropriate form:

| If You Received | Use This Form |

|---|---|

| A Notice | Form SPL-01 |

| An Order | Form SPL-02 |

- Wait for response from the GST Department

| Outcome | Form Received |

|---|---|

| Application Approved | SPL-05 (Case Closed) |

| Application Rejected | SPL-07 (See below) |

What to Do if You Receive SPL-07 (Application Rejected)

If the department rejects your application under the GST Amnesty Scheme, you will receive Form SPL-07. This could be due to:

- Ineligibility (e.g., Section 74 case)

- Incomplete documents

- Appeal not properly withdrawn

- Wrong form submitted

Next Steps:

- Review the reason for rejection mentioned in SPL-07

- Correct the issue, if possible (e.g., attach missing proof)

- Refile the appeal through Form APL-01 on the GST portal

- Optionally, consult a tax professional for guidance

Note: Once Form SPL-05 (approval) is issued, you cannot re-appeal.

Important Deadlines

| Task | Last Date |

|---|---|

| GST Tax Payment | 31 March 2025 |

| Amnesty Application Filing | 30 June 2025 |

Real Case Studies

Case 1: Retailer from Jaipur

- Received notice under Section 73 (FY 2018–19)

- Withdrew appeal, paid ₹1.5 lakh tax

- Filed Form SPL-01

- Got approval via SPL-05 — no interest, no penalty

Case 2: Freelancer from Mumbai

- Had ₹45,000 tax + ₹18,000 interest

- Paid only tax, filed SPL-02

- Received SPL-05 – interest fully waived

Legal Reference Table

| Topic | Section / Form |

|---|---|

| Amnesty Scheme | Section 128A |

| Demand Notices | Section 73 |

| Appeals | Section 107 |

| Fraud Cases (Not Covered) | Section 74 |

| Application Forms | SPL-01, SPL-02 |

| Appeal Withdrawal | APL-01 |

| Application Rejection | SPL-07 |

| Final Approval | SPL-05 |

Benefits of the GST Amnesty Scheme

- Full waiver of interest and penalty

- Clean exit from pending GST liabilities

- Simple and transparent compliance

- Helps avoid lengthy legal disputes

- Great relief for MSMEs, startups, traders, freelancers

Key Reminders

- Applies only to FY 2017–2020

- Appeal withdrawal is mandatory

- No refund of previously paid penalty/interest

- No further appeal after SPL-05 is issued

- Re-appeal only possible if application is rejected via SPL-07

Final Words: Settle It the Smart Way

The GST Amnesty Scheme is a one-time opportunity to clean up past GST issues without penalties. Whether you’re a small trader, startup, or consultant, use this time-bound relief to become fully compliant.

Need help with filing, withdrawal, or re-appeal?

Visit www.TaxGiveIndia.com — Professional GST Filing and Legal Help