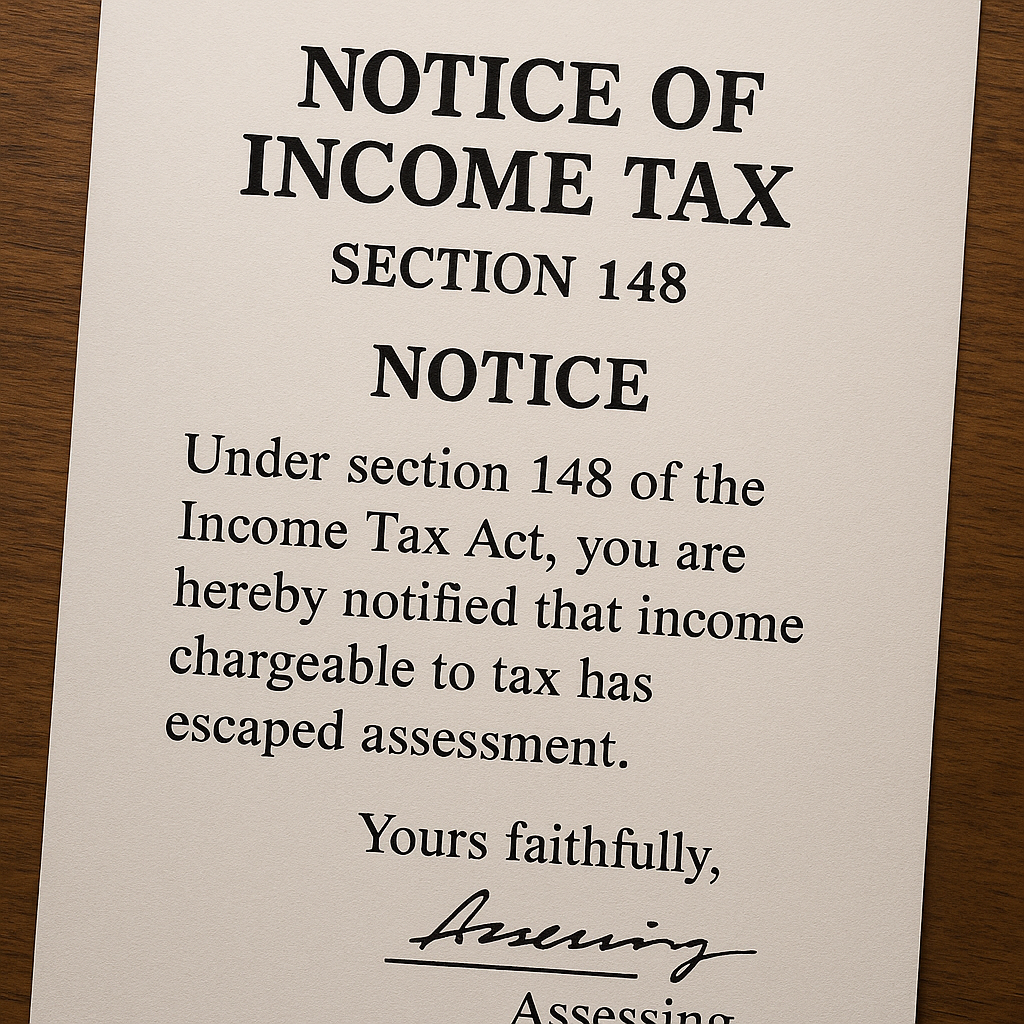

If you get a Notice u/s 148 from the Income Tax Department?

This notice is sent when income is not reported correctly, or Income Tax Return (ITR) is not filed, and the department has information that your income has escaped assessment.

In this blog, we’ll explain:

✅ What is a Notice under Section 148

✅ Reasons why you may receive it

✅ Realistic examples across various income types

✅ Time limits, actions to take, and how to avoid it in future

📌 What is Section 148 of Income Tax Act?

Section 148 allows the Income Tax Department to reopen your assessment if it believes some income has escaped tax. You are required to file a fresh return in response to this notice.

Why You May Receive Notice u/s 148

- Not filing ITR despite having taxable income

- Not reporting all incomes like FD interest, capital gains, crypto profits, freelance income

- Cash deposits or high-value transactions

- Mismatch in Form 26AS, AIS, or TIS

- Foreign travel or high credit card usage

- TDS deducted but no return filed

- Anonymous tip-offs or suspicious data

⏳ Time Limit for Issuing Notice u/s 148

- Normal Cases: Within 3 years from the end of the relevant financial year

- Serious Cases (Income > ₹50 lakh): Up to 10 years

📋 What To Do If You Receive Notice u/s 148?

- Do not panic

- Log in to https://www.incometax.gov.in

- Check the year and income mentioned

- File a response within 30 days

- Submit a return under Section 148 if required

📚 Realistic Examples of Notice u/s 148

Here are real-life case studies to understand how and why such notices are issued:

📍 Example 1 – High FD Interest Not Declared

Case: Rajat Mehta

FY: 2021–22

Missed: ₹90,000 FD interest

Notice Text:

“You have received interest income of ₹90,000 from SBI not reflected in your return for AY 2022–23. You are required to file a return under Section 148 within 30 days.”

📍 Example 2 – Property Sale Not Reported

Case: Anjali Sharma

FY: 2020–21

Missed: ₹55 lakh property sale

Notice Text:

“You sold immovable property for ₹55,00,000 in FY 2020–21. No ITR filed for AY 2021–22. Kindly furnish a return under Section 148 disclosing capital gains.”

📍 Example 3 – Freelance Income Skipped

Case: Ritu Verma

FY: 2022–23

Missed: ₹4.2 lakh freelance income via PayPal

Notice Text:

“You received ₹4,20,000 via PayPal not disclosed in ITR for AY 2023–24. Reassessment initiated under Section 148.”

📍 Example 4 – Cash Deposits Without Source

Case: Mohit Jain

FY: 2021–22

Missed: ₹12 lakh cash deposits

Notice Text:

“₹12,00,000 deposited in your bank account. No return filed. Please file return under Section 148.”

📍 Example 5 – Rental Income Ignored

Case: Preeti Malhotra

FY: 2022–23

Missed: ₹30,000/month rental income

Notice Text:

“Rental income not reported in return for AY 2023–24. Kindly file ITR under Section 148.”

📍 Example 6 – Crypto Profits Not Declared

Case: Aman Srivastava

FY: 2021–22

Missed: ₹3 lakh crypto gains

Notice Text:

“Profits from crypto trading not reported. Reassessment being initiated under Section 148.”

📍 Example 7 – International Travel Without ITR

Case: Nisha Gupta

FY: 2022–23

Missed: ₹5 lakh foreign trip, no ITR filed

Notice Text:

“₹5,00,000 foreign travel found in AIS. No return filed. Income assumed to have escaped assessment.”

📍 Example 8 – Stock Market Gains Not Reported

Case: Rahul Khurana

FY: 2022–23

Missed: ₹2.5 lakh LTCG from shares

Notice Text:

“Stock transactions found. Capital gains not reported in return for AY 2023–24. Kindly file return under Section 148.”

📍 Example 9 – High Credit Card Spending

Case: Neha Chhabra

FY: 2021–22

Missed: ₹6.5 lakh card spend, no ITR filed

Notice Text:

“₹6,50,000 credit card spending noted. No ITR filed. Please respond under Section 148.”

📍 Example 10 – TDS Seen, But No ITR Filed

Case: Pankaj Sharma

FY: 2022–23

Missed: TDS ₹12,000 deducted

Notice Text:

“TDS of ₹12,000 detected on FD interest. No ITR filed. Income considered to have escaped assessment.”

✅ How to Prevent Notice u/s 148?

- Always file ITR if income exceeds ₹2.5 lakh (even if TDS is already deducted)

- Report all income – bank interest, crypto, rent, capital gains, foreign income

- Match your Form 26AS, AIS, and TIS before filing ITR

- Keep proper records and proofs

- Consult a Expert for complex income situations

- Avoid underreporting to prevent future scrutiny